Short Sales Explained: A California Homeowner’s Guide

- Benchmark Realtors

- Aug 20

- 3 min read

A short sale in real estate occurs when a homeowner sells their property for less than the outstanding mortgage balance, with the lender's approval. Short sales became a common practice particularly after the 2008 "Great Recession". For some perspective, in 2010, short sales made up about 20% of California's sales activities... In 2024, the latest year with 12 months of data available, short sales account for less than 1% of sales.

Once you receive notice that your home is at risk of foreclosure, it's easy to fall into a dark hole of stress, depression, anxiety, and self-doubt. It's normal, and we've seen it many times. That being said, your first step in the process is to just breathe. Short sales, although they are much less common in today's market, are a part of any economy, no matter how good (or bad) the market is doing. Once you've taken a moment to process, we'll chat about the process.

Short Sale vs Equity Sale

A big part of why short sales are not as common is quite simply because many sellers have the equity to sell, and either rent, or in some cases buy. If that's the case, we'd still love to help you get a plan together - but know that you won't qualify for a short sale, and at the very least, you have some equity to put to use moving forward.

Short Sale Basics

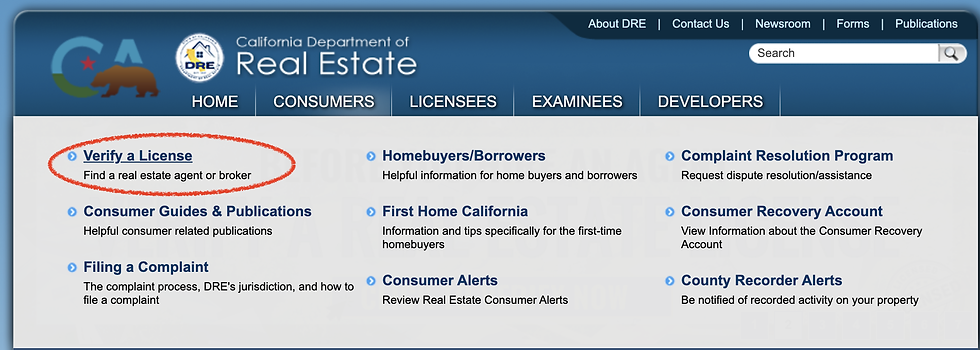

Obviously, we can't teach you every possible detail in the short sale process, but let's cover some basics. In order to initiate the process, you need to reach out to us for a free, confidential consultation. At that point, once we've inked out a plan that will work, we can begin the process of collecting documents.

In order to qualify, you must have a hardship in your life. A divorce, job loss, medical bills, pay cut, etc. Once we've made contact with the appropriate department(s), you may be asked to cease making any payments, partial or full.

Initial Short Sale Package To begin, we will need the following:

Authorization Letter: This gives us the power to negotiate and represent you to the debtors.

Financial Documents: Bank statements, tax returns, pay stubs, bills, and anything and everything else that will cement your hardship.

Hardship Letter: A detailed, heartfelt and honest letter explaining to the bank/lender why you can no longer sustain the payments of your home, and as best you can, lean on your financial documents to substantiate any claims.

Listing Agreement: This, along with the authorization letter, will put all other parties on notice that we are representing you in attempting to sell your home, and that you are actively attempting to settle the matter.

If a short sale is the best option for you, we will provide you with the necessary forms and templates to follow, as well as updates and insights as they come in.

The Short Sale Process

Surprisingly, selling a home as a short sale is similar to an equity sale. You must sign the documents, you can continue to live in your home and we work around your schedule. The escrow/due diligence process is the same, with the only exception being the timeline. That being said, we must negotiate your short sale price and the bank must accept it in order to close; if there are multiple creditors, then they must sign off on the deal as well - which we handle start to finish, so just relax and let us take the wheel!

Afterwards

Your credit is impacted less than a foreclosure, and you may be allowed to purchase in much less time than you would with a foreclosure on your record. In some cases, we also can negotiate relocation assistance money, also known as "Cash for Keys", to assist you financially in the moving process.

Beware! Short sales are a tricky process behind the scenes, and if that's not bad enough, there have been reports of brokers and companies charging money upfront for these services - DO NOT pay a single cent to anyone. We get paid by the bank in the process of negotiating your short sale.

We hope this article has given you some valuable insight into the short sale process in California. No matter what's going on, reach out to us anytime to make sure you have experienced, proven representation on all of your real estate matters!

We are not a law group, tax professionals, and our scope is limited to real estate sales. Please consult with an attorney and/or tax professional to your satisfaction for any questions relating to any legal or tax matter.

Comments