Independent vs. Non-Independent Escrow

- Benchmark Realtors

- Jul 25

- 3 min read

In California’s competitive real estate market, every decision matters—from the home you choose to the professionals you trust throughout the transaction. One important but often overlooked decision is who handles your escrow.

At Benchmark Realtors, we believe in complete transparency and client-first service. That’s why we do not operate our own broker-owned escrow company—and here’s why you should think twice before working with a brokerage that does.

The Definition of Escrow

The California Department of Financial Protection and Innovation (DFPI) defines escrow as: "“Escrow” means any transaction in which a neutral third party holds documents of ownership of either real or personal property for a buyer and seller." In some states, the escrow (or closing) process is handled by an attorney. In California, and many other states, we use an escrow and title company to handle the escrow process.

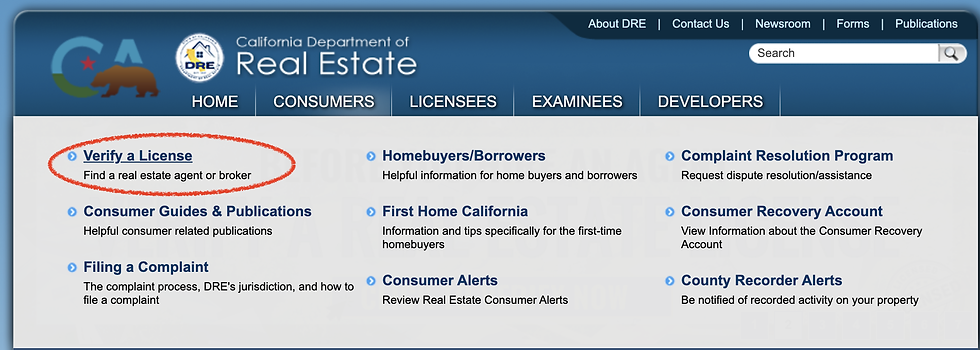

There are two types of escrow companies in California: The independent escrow company (which Benchmark uses), and also the "Non-Independent Broker Owned Escrow" company.

What's the Difference?

California real estate law allows a real estate broker to operate their own escrow company, as long as they only perform escrow on a transaction they are involved in. With the definition of escrow being a "neutral third party", a broker-owned escrow is not only neutral, but the potential for conflict of interest arises when, as the escrow holder, you also represent a client in the transaction.

By using only large, independent, national escrow companies (such as First American and Ticor just to name a few), the risk of any impropriety is decreased significantly. As is common with any other free-market organization, using companies whose only business is escrow allows these companies to compete for better pricing and service for our customers, where independent escrow companies don't have that engagement given that their transactions are only those where the broker is representing a party.

Over the years, quite a few real estate brokers found themselves in the throws of disciplinary action with the Department of Real Estate when it was uncovered that they offered their agents bonuses - in the form of a lower commission split, additional fees from the broker, and even "marathons" where agents received gifts and vacations, just for steering their clients to use the broker-owned escrow, as opposed to a third party. After all, more money in the broker and agent's pockets is a win-win... leaving only the client to wonder if they are being represented fairly, or if they are overpaying for escrow services.

Summer Goralik, a former Department of Real Estate investigator turned risk management consultant, has shared countless stories of brokers "Promising better commission splits for agents who “keep it in the family.”

Is this to say that broker-owned escrow companies are all corrupt? Absolutely not. Do "big name neutral escrow companies" ever make mistakes? Absolutely. As a real estate practitioner, our primary duty is to our clients - to ensure that there isn't even a chance for impropriety. Our job isn't to "steer" clients to any vendors or third party companies, it's to inform them of their options, who we've worked with, and let our clients make a fully informed decision.

As for Benchmark, we prefer swimming in our own lane. Real estate is our passion, and we won't try to swim in escrow's lane. Remember that, as a consumer, you drive the bus. Don't ever feel pushed or forced to choose any vendor during the real estate process until you feel comfortable with the decision you make.

Comments